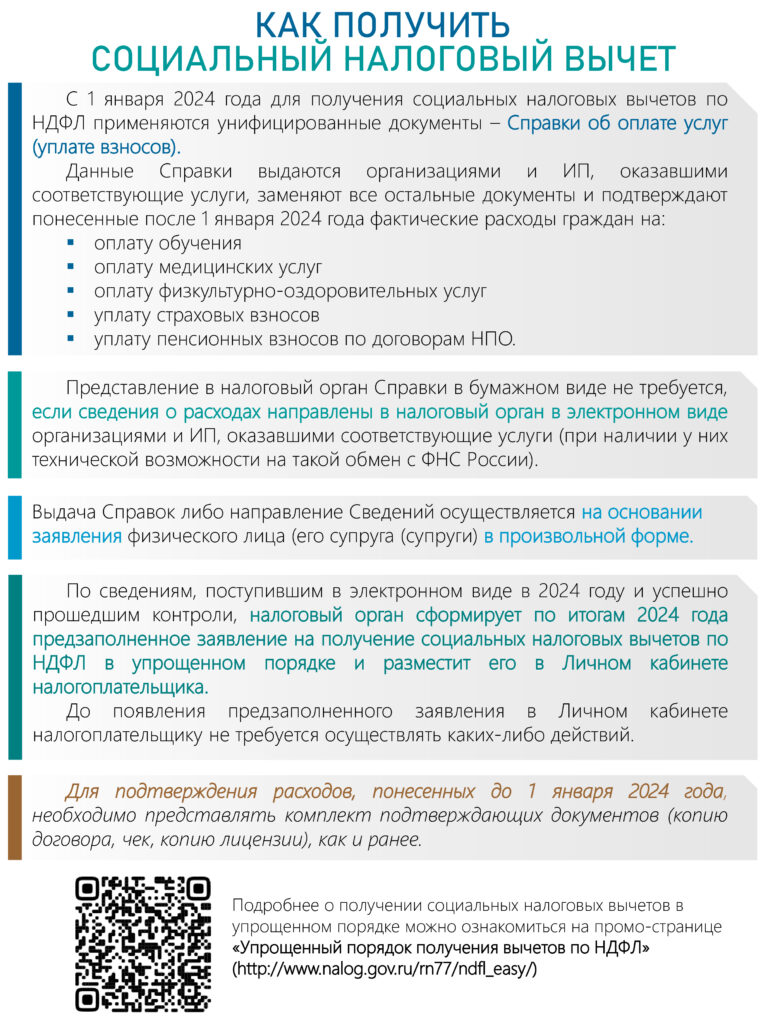

How to get a social tax deduction

From January 1, 2024, to receive social tax deductions for personal income tax, unified documents are used - Certificates of payment for services (payment of contributions).

These Certificates are issued by organizations and related services, replace all other documents and confirm the actual expenses of citizens incurred after January 1, 2024 for:

- tuition fees

- payment for medical services

- payment for physical education and health services

- payment of insurance premiums

- payment of pension contributions under NGO agreements.

Submission of a Certificate in paper form to the tax authority is not required if information on expenses is sent to the tax authority in electronic form by organizations and individual entrepreneurs who provided the relevant services (if they have the technical ability to carry out such an exchange with the Federal Tax Service of Russia).

The issuance of Certificates or the sending of Information is carried out on the basis of an application from an individual (his spouse) in any form.

According to information received electronically in 2024 and successfully passed controls, the tax authority will generate a pre-filled application for receiving social tax deductions for personal income tax in a simplified manner based on the results of 2024 and will post it in the taxpayer’s personal account.

Before the pre-filled application appears in the Personal Account, the taxpayer does not need to take any action.

To confirm expenses incurred before January 1, 2024, it is necessary to submit a set of supporting documents (copy of the contract, receipt, copy of the license), as before.